DES MOINES, Iowa – Due to the COVID-19 pandemic, the City of Des Moines this fiscal year is estimated to lose $25 million dollars in revenue. In releasing loss estimates today, City Manager Scott Sanders said the coronavirus outbreak has severely affected city revenues which will continue into the next fiscal year.

“While the health and safety of residents is our greatest priority, we must also be mindful of the financial impact the pandemic is having on City revenues,” Sanders said. “Now that we have determined the extent of the impact into mid-2022, our next step is to implement a plan that best serves Des Moines residents.”

Sanders and the City’s Finance Department are currently working on the amended fiscal year 2021 budget and the recommended fiscal year 2022 financial plan.

“As we begin the budget process, we’re taking into account the COVID-related impact so that we can address both short-term and long-term financial concerns,” Sanders added.

“At the end of this summer Des Moines officials noted that the local option sales tax that was recently passed had generated $38 million in new revenue so from that perspective, they are still ahead with that new tax,” Chris Ingstad, president of Iowans for Tax Relief, told The Iowa Torch.

He pointed out that Des Moines’ use of tax increment financing (TIF), a public financing method that provides tax rebates to developers has not helped the city budget.

“In the never-ending game of picking winners and losers they certainly have given away a lot of tax dollars that might have come in handy right now,” Ingstad said.

Drew Klein, Iowa state director for Americans for Prosperity, also warned about TIF.

“There have been warning signs all along for cities in general, but Des Moines specifically about debt entanglements,” he told The Iowa Torch.

“Even without the pandemic, this provides a risk for taxpayers in the future,” Klein added. “(Des Moines City Council) needs to budget with disaster in mind.”

Ingstad noted that the city manager’s initial response appears to be the right approach.

“To his credit, Mr. Sanders has discussed reprioritizing projects, scaling back, and generally moving ahead at a slower pace than planned, which are all the right things to do,” he said.

“The wrong thing to do would be to turn to Des Moines residents and visitors to try to squeeze more dollars out of them by increasing a rate or creating some new revenue stream,” Ingstad warned.

Klein added Des Moines needs to be better prepared.

“Prudent government budgets in a way to set themselves up to handle those. Des Moines has not done that,” he said.

Ingstad noted that it is vital for Des Moines residents to be engaged.

“More important than what I think is what Des Moines residents think. Their elected officials are going to be crafting the budget for their city and there will be opportunities for them to weigh-in, ask questions, and ultimately hold elected officials and staff members accountable for the decisions they are making with the budget,” he added.

On December 22, Sanders and Finance Director Nick Schaul will conduct via Zoom a Budget Education and Engagement Workshop for residents. A webpage has been developed to provide informational videos and details about the City’s budget process. The City is also seeking comments and questions from residents prior to the online budget presentation. Details of that workshop may be found at DSM.city/budget.

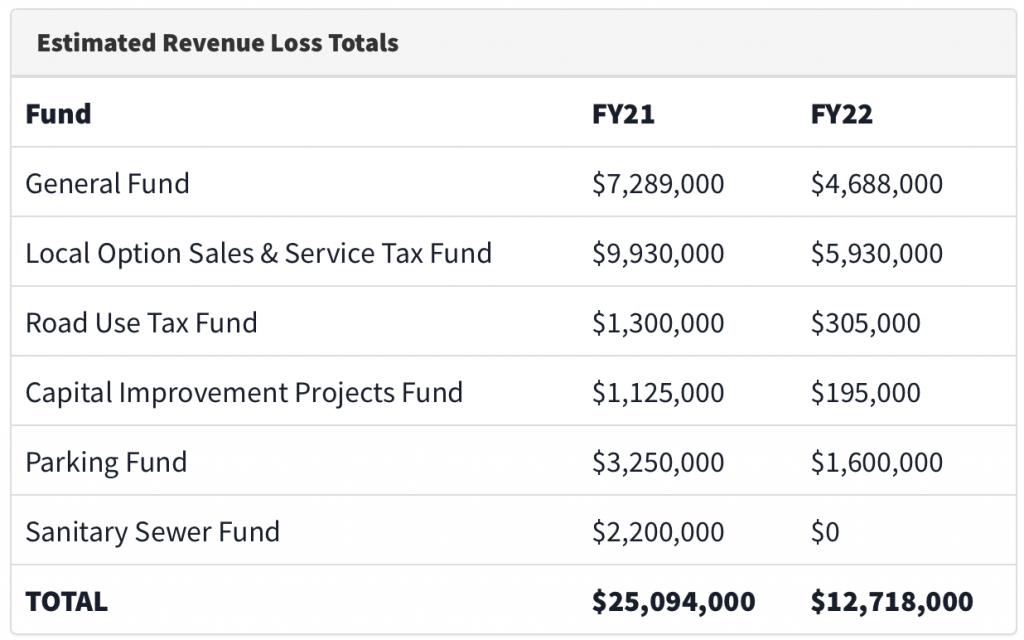

Sanders said he estimates that revenue loss could diminish by about half, or to $12.7 million for the fiscal year beginning July 2021. A detailed report on the estimated revenue loss can be found below.

COVID Financial Impact_Revenue Table

The Iowa Torch reached out to Mayor Frank Cownie and Des Moines City Council members for comment earlier this after, but at the time of publication had not heard back from anyone except Councilman Bill Gray who encouraged The Iowa Torch to contact the city’s finance department.