The national debt is rapidly nearing $29 trillion, which is 25 percent more than our entire economy, and is orders of magnitude higher if you consider unfunded liabilities of Social Security and Medicare. This threatens life as we know it and must be addressed now.

Since the start of 2020, the debt has increased by $5.2 trillion. And President Joe Biden has called for $6 trillion in new spending along with massive tax hikes that will hinder growth and add trillions more in debt. The most recent spending plans are the $1.2 trillion “infrastructure” bill, which is really a green-energy boondoggle, and the at least $3.5 trillion reconciliation package that has been described as “human infrastructure,” which greatly expands the welfare state.

This expansion of the welfare state is far more than President Franklin Delano Roosevelt’s New Deal or President Lyndon B. Johnson’s Great Society. Although these initiatives likely had good intentions, the results were a disaster with the former driving the Great Depression deeper and longer and the latter contributing to greater dependency and rising structural deficits.

President Biden’s Green New Deal would fundamentally transform America into something it is not, nor can it afford to be. Many progressives argue that the federal government can continue to deficit spend without consequence. While we expect this from progressives, where are the conservatives?

Both political parties share the blame for the rising burden of government that comes from excessive government spending.

For example, 19 Senate Republicans voted for the $1.2 trillion “infrastructure” bill that spends less than 10 percent on conventional infrastructure such as roads and bridges.

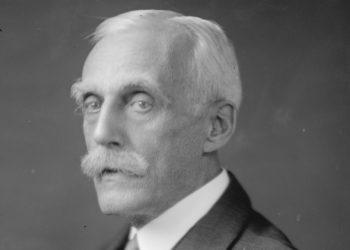

The political calculus of this maneuver by Republicans is awful and troubling as Americans need elected officials to take fiscal responsibility seriously now. A great example is that by President Calvin Coolidge, who believed in the morality of a limited government and was the ultimate budget hawk.

Coolidge, along with his predecessor, President Warren Harding, made cutting government spending a priority. When Harding assumed office, he was confronted with the Depression of 1920-1921 and his response was to fight it by removing government obstacles of excessive spending and taxing, which helped get the U.S. out of that situation in a hurry. After Harding’s death, Coolidge continued Harding’s pro-growth fiscal conservatism as Coolidge regarded “a good budget as among the noblest monuments of virtue.”

For Coolidge, keeping a balanced budget with spending restraint and reasonable tax rates was not just sound economic policy but moral and constitutional, as it supported increased economic prosperity along with preserving life, liberty, and the pursuit of happiness.

Under President Coolidge, federal spending decreased by 0.4 percent, from $3.14 billion in 1923 to $3.13 billion in 1928. This means the budget declined by even more in inflation-adjusted terms and resulted in spending as a share of GDP declining from 3.7 percent to three percent, which compares with the astronomical $6.6 trillion for nearly one-third of GDP in 2020. As a result of cutting spending, Coolidge was able to lower the top income tax rate to 25 percent in 1926, as he noted that “You can’t increase prosperity by taxing success.”

The spending restraint, tax cuts, and faster economic growth helped the federal government run a budget surplus every year for a cumulative cut in the national debt over those seven years of $6.1 billion. As a result of Coolidge’s fiscal conservatism, the nation experienced the Roaring ‘20s because free-market capitalism was allowed to work much more than today.

“The very fact that the federal government has been able to cut down expenditures, decrease its indebtedness and reduce its taxes indicates how great is the accomplishment which you have made on behalf of the people of the nation,” noted Coolidge.

Although the budget has changed since Coolidge was in office, Amity Shlaes, noted historian and Coolidge biographer, wrote that “the pressure to expand programs was as strong [then] as it is today.”

Policymakers should follow Coolidge’s example and reduce spending. States such as Texas and Iowa have also proved that fiscal conservatism works, so the federal government should now do the same. The Texas Public Policy Foundation’s Responsible American Budget provides a blueprint to restoring fiscal sanity in Washington.

Excessive government spending and the national debt cannot be ignored. If America doesn’t change course quick, there will be catastrophic results for Americans and Western Civilization. This is not just dangerous; it is un-American and something that will keep us from leaving a legacy to be proud of.

We need Calvin Coolidge’s fiscal conservatism more than ever.