Property taxpayers in Iowa keep growing frustrated and they are tired of the blame game that is played by local governments to avoid answering why tax relief is next to impossible. Property taxes fund local governments and often blame is shifted from one tax authority to another to justify why tax bills are high. In addition, local governments also respond that if property taxes are reduced then it will result in cuts to essential services such as police, fire, and emergency response services. Iowa property taxpayers deserve a solution and thankfully, a solution exists that will place greater transparency and accountability on local governments. Establishing a strong Truth-in-Taxation law will provide the solution that property taxpayers are looking for and it will force local governments to be more accountable to taxpayers.

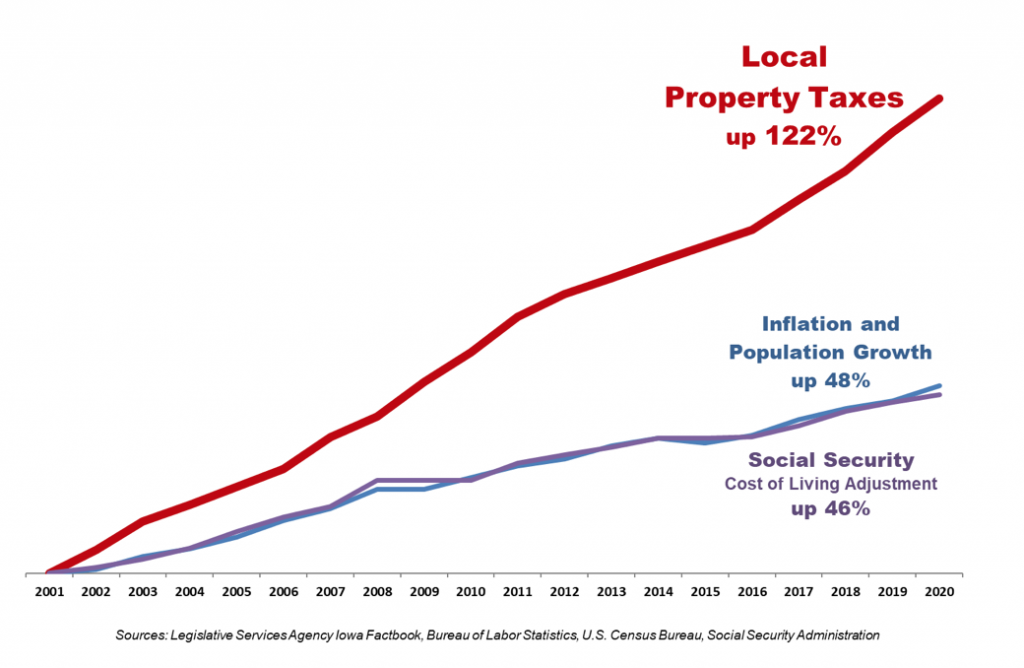

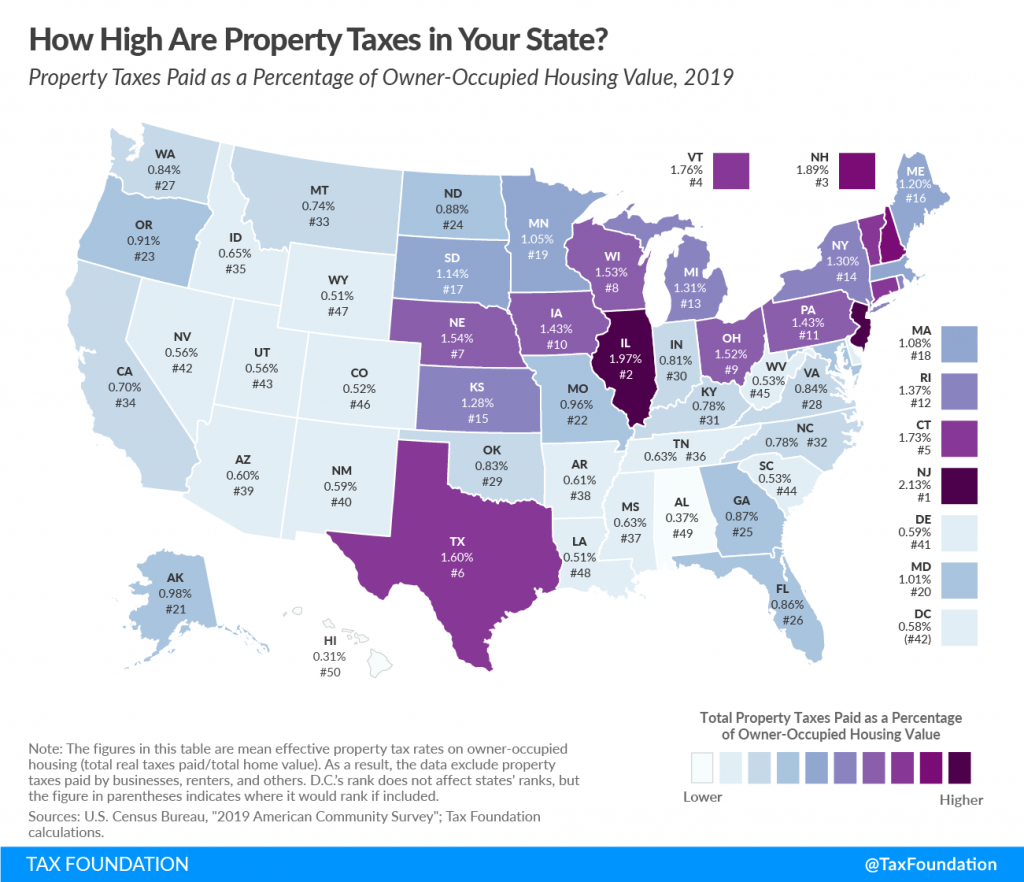

Since 2000, Iowa property taxes have increased 122 percent more in comparison to population, inflation, and the cost-of-living adjustment for Social Security. The Tax Foundation ranked Iowa with the 10th highest property tax burden in the nation.

Local government spending is at the heart of high property taxes. Too often blame is placed on the county Assessor, but taxpayers must focus their attention on spending. Whether it is property or income taxes, spending drives high taxation. In addition, many property taxpayers in Iowa are often left wondering why they are told taxes have decreased, but their property tax bills are higher.

Local government spending is at the heart of high property taxes. Too often blame is placed on the county Assessor, but taxpayers must focus their attention on spending. Whether it is property or income taxes, spending drives high taxation. In addition, many property taxpayers in Iowa are often left wondering why they are told taxes have decreased, but their property tax bills are higher.

Utah’s Truth-in-Taxation law is a revenue-based limitation, which means as valuations increase property tax rates decrease. The Truth-in-Taxation law guarantees that each taxing entity receives the same property tax revenues as the previous year including new growth. This prevents local governments from getting a windfall because valuations have increased. “Local governments should not receive an automatic 12 percent revenue increase simply because property valuations increased 12 percent,” wrote Howard Stephenson, who recently retired as President of the Utah Taxpayers Association and is a former state Senator.

If a local government wants to exceed the certified tax rate, it then requires a Truth-in-Taxation hearing that is accompanied by an extensive public notification and hearing process. Truth-in-Taxation also forces local government officials to take recorded votes to approve an increase in tax collections.

Through the Truth-in-Taxation process, local governments must justify why they want to increase taxes for additional spending, forcing them to be more transparent as to why they need additional tax revenue. A crucial aspect of Utah’s law is a direct notification requirement, where notices are sent to taxpayers, providing information on the proposed tax increase and how it will impact their tax bill. It also includes the date, time, location of the Truth-in-Taxation budget hearing. This extensive public notification and hearing process has been successful, and taxpayers in Utah actively participate in Truth-in-Taxation hearings.

Rusty Cannon, President of the Utah Taxpayers Association, argues that Utah’s law provides “sunlight” on the local government budgeting process. Cannon noted that while “decisions can be made to raise taxes, the law simply requires that it’s done in the sunlight—that you essentially need to make your case to voters, to taxpayers, as to why the increase in revenue is needed.”

Truth-in-Taxation forces accountability and it makes taxing authorities think twice about raising taxes. “You do it in a public setting, you notify them of what their liability increase will be on a parcel-by-parcel basis, so everybody has that full disclosure. So, there’s no automatic inflation that creeps in. There’s no automatic step-up. There’s no automatic windfall if property values increase. It keeps a lid on those property taxes. However, if they do want to raise them, they simply have to do it in that public process,” stated Cannon.

In describing the success of Utah’s Truth-in-Taxation law, Jonathan Williams, Chief Economist at the American Legislative Exchange Council, wrote:

“Utah’s Truth in Taxation law has effectively controlled the growth of its property tax assessments and overall burdens. The law requires that citizens be notified of the intent to raise taxes and invited to a public hearing to voice concerns. This also allows local units of government to make their case if they feel additional revenue may be needed. If a local government decides they want to increase spending, the Truth in Taxation process requires local elected officials take recorded votes to authorize the new rates or assessments.”

Recently Kansas and Nebraska passed property tax reform laws based on Utah’s Truth-in-Taxation. The Kansas law serves as the closest example to Utah’s law because of its strength. Dave Trabert, President of the Kansas Policy Institute, argues that the new Kansas law “closes the property tax honesty gap.” “Local officials can no longer pretend to ‘hold the line’ on property taxes while taking in large increases from valuation changes. Now, they have to be honest about the entire tax increase they impose,” stated Trabert.

Specifically, the Kansas law repeals the property tax lid, which was largely ineffective because of the numerous exemptions and starting in 2021 mill rates will be reduced so that new valuations will bring in the same amount of property tax. If a taxing authority wants to increase property taxes, they will be required to hold a public hearing and vote on the potential increase. This also includes a direct notification process, which must include:

- The revenue-neutral rate for each relevant taxing subdivision;

- The proposed tax rate and amount of tax revenue to be levied by each taxing subdivision seeking to exceed its revenue-neutral rate;

- The tax rate and amount of tax from each taxing subdivision for the property from the previous year’s tax statement;

- The appraised value and assessed value for the taxpayer’s property for the current year;

- The estimated amount of tax for the current year for each subdivision based on the revenue-neutral rate and any tax rate in excess of the revenue-neutral rate and the difference between such amounts for any taxing subdivision seeking to exceed its revenue-neutral rate;

- The date, time, and location of the public hearing for each taxing subdivision seeking to exceed its revenue-neutral rate; and information concerning statutory mill levies imposed by the State of Kansas.

Kansas’s Truth-in-Taxation law is already working for taxpayers. Several cities and counties are not going to increase their property taxes next year, while others are looking at small increases.

Policymakers in Iowa should seriously consider following the example of Utah and Kansas and pass a Truth-in-Taxation measure that requires a strong direct notification requirement. Taxpayers deserve to know how much their property tax bill will increase and Utah and Kansas are demonstrating that Truth-in-Taxation laws force more “sunlight” and accountability on the local government budget process.

Public officials should not be afraid of Truth-in-Taxation. Providing more accountability and transparency will only improve local government. “Just as someone who doesn’t want to be seen in a swimsuit should avoid the beach, those that don’t want to make decisions in public should not run for public office,” stated Cannon in referring to transparency in government.

“And that is the idea behind Truth in Taxation, is that you can make the decision, you just have to do it in the open,” noted Cannon. In addition, elected officials should explain to taxpayers why they need additional spending. Too often governments, at all levels, forget that it is the money belongs to the hard work of the taxpayer.

In the last few years, Governor Kim Reynolds and the legislature have made significant progress in starting to lower Iowa’s high tax rates. Much work remains in lowering individual and corporate income taxes to make Iowa’s economy more competitive. The same is true for property taxes. High property taxes deter economic growth and provide incentive for people to either leave or decide not to locate to Iowa.

It’s time to implement a proven solution to bring property tax relief to Iowa taxpayers. Other reforms such as property tax freezes for certain taxpayers or assessment limitations may sound promising, but these “solutions” will not solve the problem. The goal should be property tax relief for all Iowans and Truth-in-Taxation will benefit all taxpayers.