Out-of-control government spending is a dangerous problem that both political parties are failing to address. The national debt of the United States is $28 trillion and rising and the federal government continues to run massive deficits. The COVID-19 pandemic has only escalated government spending. The national debt represents a significant crisis for the nation. A recent review of the federal government’s finances by Truth in Accounting estimates that the national debt is $123.11 trillion when the unfunded liabilities of Social Security and Medicare are taken into consideration. This would require each taxpayer to pay $796,000 to pay off our massive debt.

“How much debt is too much, and when does it begin to have corrosive economic consequences,” asked a recent editorial by The Wall Street Journal? “History shows that massive national debt is a major cause of decline, even extinction, of nations that refuse to live within their means,” wrote columnist Cal Thomas.

It is not only out-of-control spending that is driving the debt, but also the unfunded liabilities of entitlement programs such as Social Security, Medicare, and Medicaid. Truth in Accounting estimates that the unfunded liabilities for Social Security and Medicaid alone are over $96 trillion.

It appears that federal spending will not be slowed anytime soon. President Joe Biden and the Democrat Congress passed a $1.9 trillion stimulus, the American Rescue Plan, and trying to pass a $2 trillion “infrastructure” spending bill. In addition, President Biden and Democrats are calling to increase the corporate tax from 21 percent to 28 percent. This, and other proposed tax increases, will not only punish taxpayers, but will be detrimental for the economy.

Economist Larry Kudlow has described President Biden’s economic plan as throwing a “wet blanket” on the economy. In addition, Kudlow described the Biden administration’s spending as “beyond extravagant.” “That’s why it’s really a shame that the Biden administration wants to fiddle with free enterprise and come crashing down with huge tax hikes and regulatory red tape, all of which are major interventions,” stated Kudlow.

President Biden is hoping that his administration is more progressive than either President Franklin D. Roosevelt’s New Deal or President Lyndon B. Johnson’s Great Society. The Biden administration, just as with Presidents Roosevelt and Johnson, believes that the federal government is “primary driver of growth.”

President Biden’s “Build Back Better” plan is based on policies that not only expand the size and scope of the federal government, but transform social welfare policy, while escalating the national debt. Even before Congress passed the American Rescue Plan many states were in recovery from the COVID-19 pandemic and did not even need these stimulus dollars. In fact, much of the $4 trillion in COVID-19 stimulus money passed by Congress was left unspent.

Many progressive and liberal policymakers are arguing that the federal government can just continue to spend money without any consequences. This is the argument of the modern monetary theory.

The insanity of the modern monetary theory argues that debt does not matter, but the nation is entering into dangerous territory. How long can Uncle Sam avoid the consequences of the laws of economics? “Huge deficit spending may prompt a financial crisis, induce rising inflation and interest rates, and generate long‐term economic harm,” stated Chris Edwards, Director of Tax Policy studies at the CATO Institute.

“This gusher of spending is greatly damaging. This is not monopoly money, but rather it represents real resources that will be confiscated from people when the bills come due,” argues Edwards.

How can we address the massive national debt before it is too late? First, it will take a cultural change from the American people to revive the principles of the American Founding, which created a Constitution based upon limited powers. Second, the Republican Party must make limited government a priority.

“Inside the Republican Party, once a church preaching small government and balanced budgets, the deficit hawks are going the way of the passenger pigeon — toward extinction,” wrote columnist Patrick J. Buchanan.

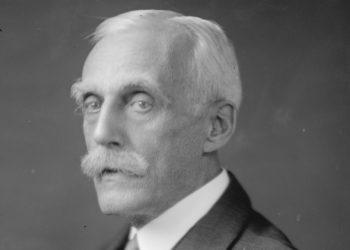

Republicans should look to President Calvin Coolidge as an example. President Coolidge was the ultimate “budget hawk.” A fundamental aspect of Calvin Coolidge’s philosophy was that he did not separate economics and morals. He saw them as one and the same. Coolidge regarded “a good budget as among the noblest monuments of virtue.”

Coolidge often argued for “economy in government,” which was tied to his devotion to the Constitution. For Coolidge, keeping a budget in balance with low tax rates was not just sound economic policy, but also both moral and constitutional. A federal government that was limited was not only the best economic policy for growth but also it was moral in the sense that it protected economic liberty and the Constitution.

President Coolidge, who assumed office after the death of President Warren G. Harding, continued Harding’s spending, and tax reductions. Under President Calvin Coolidge the federal budget fell from $3.1 billion in 1923 to $2.9 billion in 1928, with the low point being $2.8 billion in 1927. The late historian Robert Sobel wrote in Calvin Coolidge: An American Enigma that “there had been a budget surplus of $292 million in 1920, which rose to $509 million in 1921, $736 million in 1922, and declined slightly to $712 million in 1923, and rose to $963 million in 1924.”

The fiscal conservatism of both Harding and Coolidge resulted in a period of significant economic growth, even in the aftermath of a severe depression in 1921. “The Roaring Twenties were a time of unprecedented prosperity. GNP expanded year after year without inflation. Productivity improved, and real wages increased. The stock market tripled,” noted Jim Powell, a Senior Fellow at the Cato Institute.

“Unemployment, 12 percent when Harding took office, was three percent when Calvin Coolidge left. Manufacturing output rose 64 percent in the Roaring Twenties. Between 1923 and 1927, U.S. growth was seven percent a year. At decade’s end, America produced 42 percent of the world’s goods,” wrote Buchanan in reflecting on the economic record of Harding and Coolidge.

Americans must heed the lesson that government cannot drive economic growth. Roosevelt’s New Deal failed to solve the Great Depression and Johnson’s Great Society “war on poverty” neglected to solve poverty. Both were only successful at expanding federal power. In fact, history demonstrates that reducing the size and scope of government is almost impossible.

“There appears to be no historical evidence that once a Western democracy expands central power and control of the nation’s resources that it ever willingly gives up those gains,” argued Buchanan.

Coolidge also left the nation a warning that if the federal government and the citizenry drift away from both economy in government and constitutional principles the result will be devastating. “One of the chief dangers to the success of popular government is that it will throw away self-restraint and self-control and adopt laws, which being without sound economic foundation, bring on such a financial distress as to result in want, misery, disorder, and the dissolution of society,” stated Coolidge.

Coolidge’s fiscal conservatism serves as a reminder for the nation today that not only is limited government good for a strong national economy, but it also takes a moral commitment from both citizens and policymakers to uphold constitutional principles.