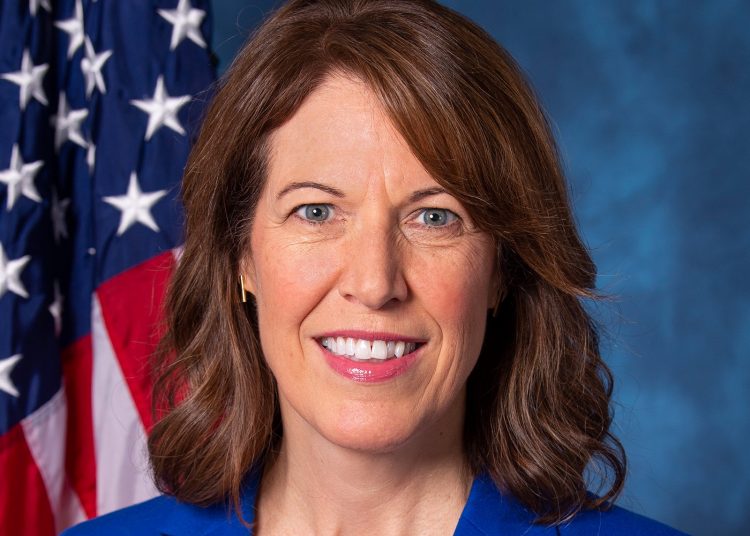

WASHINGTON – On Thursday, U.S. Rep. Cindy Axne, D-Iowa, introduced bipartisan legislation to support rural businesses by providing up to nine months of loan relief as her first bill of the 117th Congress. The legislation aims to help rural communities struggling financially because of the coronavirus (COVID-19) pandemic.

The Rural Equal Aid Act, introduced today with U.S. Reps. Troy Balderson, R-Ohio, Lisa Blunt Rochester, D-Del., and Jared Golden, D-Maine, would cover the full principal, interest, and fees on certain U.S. Department of Agriculture (USDA) loans for six months, and up to $9,000 per month for an additional three months after that.

The measure would match similar relief provided to Small Business Administration (SBA) loan holders by the CARES Act and the COVID-19 relief package signed into law last December.

“The Main Streets of our rural communities are no less deserving of federal relief efforts that have been implemented to help keep our businesses afloat through these tough times. This is a commonsense, bipartisan measure that extends the same relief that SBA constituents received to USDA constituents,” Axne said. “I’m proud to make this my first piece of legislation of the new Congress, because this represents one of my primary goals of this Congress. Rural America cannot be left behind by relief efforts, and the bipartisan support for this bill illustrates how important it is that we secure this measure in the next round of COVID-19 aid.”

The Rural Equal Aid Act’s relief window would cover the payments, including principal, interest, and fees, for borrowers using four USDA loan programs:

- Community Facilities loans,which are loans made to public and nonprofit organizations for essential community facilities like hospitals, libraries, child care, and community centers, and public facilities like fire stations or town halls.

- Business and Industry loans made to small businesses, cooperatives, and nonprofits to develop and expand businesses in rural areas.

- Two loan programs made through small local intermediaries. The borrowers from these programs are often unable to access other credit and may have been unable to use the Paycheck Protection Program because they don’t have existing banking relationships.

-

- The Intermediary Relending Program, which provides loans of no more than $250,000 made to borrowers who are unable to get credit elsewhere, but need capital to get started or expand their business. These loans average less than $100,000 and support small local businesses.

- The Rural Microentrepreneur Assistance Program (RMAP), which offers loans of no more than $50,000 through local nonprofits. These loans are available to businesses with no more than 10 employees, making them a frequent choice for entrepreneurs looking for capital to start up a new business. In addition, RMAP loans are frequently used by women entrepreneurs.

The legislation has the support of the Center for Rural Affairs, American Bankers Association, Iowa Bankers Association, National Rural Housing Coalition, and the National Association of Towns and Townships.

The Rural Equal Aid Act was originally introduced by Axne in August 2020. The updated version of the legislation introduced today provides the extra three months of relief of up to $9,000 per month to mirror additional SBA relief provided in December’s COVID-19 relief package.