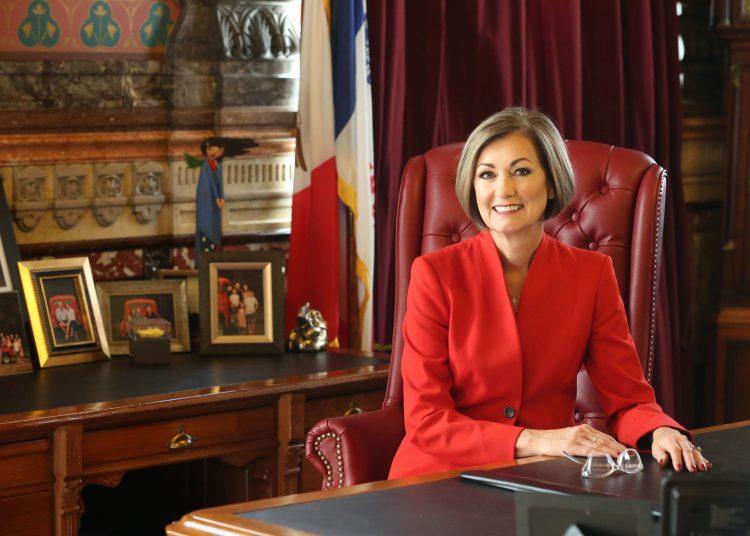

(The Center Square) – Gov. Kim Reynolds signed a bill Wednesday that allows Iowa’s flat income tax rate to go into effect in tax year 2025, a year earlier than planned, and at a lower rate than originally proposed.

Lawmakers passed a tax package that reduced income taxes while gradually moving toward the flat tax. Senate File 2442 moved the flat tax ahead at a rate of 3.8%, instead of 3.9%.

“The bottom line is that every Iowa taxpayer will experience significantly lower rates starting next year, and collectively, all the tax cuts we’ve enacted since 2018 will save Iowans more than $23.5 billion over a decade,” Reynolds said.

The bill also eliminated taxes on retirement and inheritance income.

SF 2442 was one of several bills signed by Reynolds on Tuesday.

The governor also signed House File 2668, which requires insurance companies to cover biomarker testing.

“Research and technology have helped save countless lives from cancer and this bill opens new opportunities for Iowans to receive the best care they can to win the battle against cancer,” Reynolds said. “I’ve seen firsthand what a difference biomarker testing can make. These necessary advancements will be available to patients across Iowa.”

Reynolds also signed House File 2319, which bans guaranteed income programs in the state.

A pilot program is currently underway in Des Moines. UpLift – The Central Iowa Basic Income Pilot – doled out its first $500 to recipients last May to residents in Polk, Dallas, and Warren counties, according to the program’s website. The 24-month program aims “to study the impacts of a sustained monthly income on participants’ health and well-being.” The bill will not affect the program.