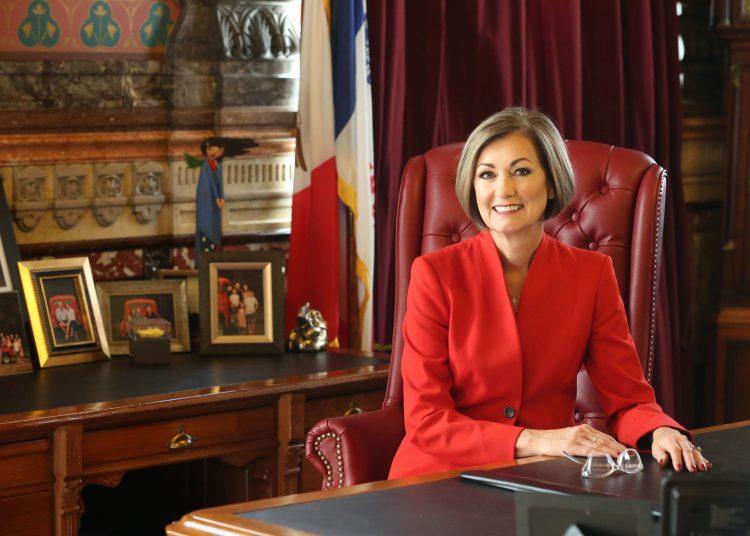

Heading into the 2024 legislative session Iowa is in a strong financial position. This was the message from the Revenue Estimating Conference (REC). Even with phased in tax reductions Iowa revenue remains strong. The December REC estimate, which will be used by Governor Kim Reynolds to create the Fiscal Year (FY) 2025 budget proposal, is projecting $9.6 billion in revenue. Iowa’s fiscal strong fiscal foundation is the direct result of conservative budgeting and pro-growth tax reforms.

Critics were quick to point out that the REC estimates showed a decline in revenue as a result of the tax cuts. The REC estimated that in FY 2024 the state will take in $9.75 billion, which is a 1 percent decline from the previous year. The $9.6 billion estimate for FY 2025 is a 1.1 percent decline in revenue. Although this is a decline in revenue what is often forgotten that this “decline” translates into Iowans being allowed to keep more of their money.

Further, the estimated decline in revenue is not as severe as expected. One reason for this was the strength of Iowa’s economy even with all the national economic uncertainty. Kraig Paulsen, chair of the REC and Director of the Iowa Department of Management, described this as “organic” growth. The REC also noted that both sales and corporate tax revenue continue to be strong.

“The December REC meeting again confirmed the strength of the Iowa economy and the benefits of bold tax cuts passed in 2018 and 2022. Hundreds of millions of dollars in tax cuts have helped Iowans keep more of their money to fight inflation and increase the reward for their work and investment,” stated Iowa Senate Majority Leader Jack Whitver.

For the last few years Iowa’s budget has been in surplus, ending fiscal year 2023 with a $1.83 billion surplus, which was $86.3 million higher than originally estimated. The fiscal year 2024 surplus is projected to be $2.1 billion, rising to $3 billion in the fiscal year 2025.

Iowa’s reserve accounts are filled at their statutory maximums and are projected to continue at this level in fiscal years 2024 ($961.9 million) and 2025 ($963.7 million). The surpluses have also fueled an enormous growth in the Taxpayer Relief Fund. The Taxpayer Relief Fund has a current balance of $2.73 billion and this is projected to increase to $3.66 billion in fiscal year 2024 and $3.847 billion in fiscal year 2025.

The large budget surpluses and the growth in the Taxpayer Relief Fund also demonstrate that Iowa is still collecting too much from taxpayers. This has led both Governor Reynolds and legislative leaders to state that further income tax reform will be a priority in the 2024 legislative session.

“Projected revenues are expected to exceed state spending by $1.233 billion this year, setting the stage for Senate Republicans to seek more income tax relief, while implementing another conservative state budget,” stated Senator Whitver.

Critics of Governor Reynolds and the legislature have been vocal in that not only are programs being underfunded, but additional tax cuts will have devastating consequences. Both arguments are wrong. First, the state budget continues to grow, and the priorities are being met and second, the “crying wolf” over the supposedly “devastating” effect of tax cuts has failed to come to fruition.

Plus, the evidence from other states clearly demonstrates that the progressive tax and spend agenda does not work. The Wall Street Journal noted that California, “after a $100 billion budget surplus two years ago is now staring at a $68 billion shortfall,” and Minnesota is projecting a $2.3 billion deficit for the 2026-2027 biennium.

Why is Iowa’s fiscal foundation so strong? It is the direct result of conservative budgeting, combined with conservative revenue estimates, and responsible pro-growth tax reforms. As a result, 2024 will be a historic year for Iowa taxpayers.