President Joe Biden and members of Congress should pay more attention to the pro-growth fiscal policies occurring in the states. The federal budget process is a disaster, and the out-of-control spending has led to high inflation. The national debt is approaching $31 trillion and rising. Federal policymakers should look to Iowa as an example for sound fiscal policy. Governor Kim Reynolds is demonstrating that prudent budgeting and pro-growth tax reforms lead to a stable fiscal foundation and strong economy.

The Cato Institute recently released its 2022 Fiscal Policy Report Card on America’s Governors and Governor Reynolds received the highest rank. Governor Reynolds received an “A” grade for her fiscal conservatism. “Kim Reynolds of Iowa has been a lean budgeter and dedicated tax reformer since entering office in 2017,” wrote the authors of the report Chris Edwards, the Kilts Family Chair in Fiscal Studies, and Ilana Blumsack, a research associate, at the Cato Institute. Edwards and Blumsack note that under Governor Reynolds leadership general fund spending has risen at just a 2.3 percent annual average rate.” Prudent budgeting and fiscal conservatism are working for Iowa.

Recently, Governor Reynolds announced that Iowa’s budget will end Fiscal Year 2022 with a $1.91 billion surplus. The follows Fiscal Year 2021 $1.24 billion surplus. This is a result of conservative budgeting. In addition to having close to a $2 billion surplus, Iowa’s reserve funds will be at their statutory full levels of $830 million and the Taxpayer Relief Fund will have a balance of $1.06 billion. As a result of strong revenue growth, the corporate tax rate is scheduled to be reduced.

Corporate tax receipts will exceed $850 million, which will translate in a 14.2 percent reduction in the top rate. The 9.8 percent rate will be lowered to 8.4 percent, which was not anticipated to occur until 2027.

Since 2018, Governor Reynolds and the legislature have made tax reform a priority. This spring Governor Reynolds signed into law the largest tax relief measure in state history. Under the new tax reform law, the current nine bracket progressive income tax rate system will be gradually reduced until it reaches a flat 3.9 percent by 2026. The corporate tax, which currently stands at a top rate of 9.8 percent, will be phased down until it reaches a flat 5.5 percent.

Critics of tax reform in Iowa have utilized the tired arguments of “tax cuts for the rich” and that Iowa would become another “Kansas,” because tax cuts would lead to a budget disaster. These same critics argue that the tax cuts will harm vital services. However, these arguments have proven to be false.

As a result of prudent budgeting, Governor Reynolds and the legislature are funding the priorities of government. It is only in government when the growth of spending is slowed it is viewed as a cut.

“Time and again over the last five years, we’ve ignored the self-appointed experts who insisted that tax cuts and economic prosperity wouldn’t be worth the cost,” said Gov. Reynolds. Further, Governor Reynolds noted that the “budget numbers show, they were worth every penny. It turns out that growth-oriented policies and fiscal restraint are a powerful combination.”

This year Iowa is one of several states that have enacted pro-growth tax reforms that will transition their income tax to a low flat rate. Iowa’s tax reform is the most comprehensive. In achieving this reform, Iowa is following the North Carolina model.

North Carolina is considered the gold standard for state tax reform. This year North Carolina continued to lower rates and their corporate tax is scheduled to be eliminated. The reason North Carolina has been so successful is it has followed a policy of fiscal conservatism by limiting spending and enacting prudent tax reforms.

The foundation of any tax reform is to keep spending limited. Governor Reynolds and the legislature are practicing priority-based budgeting and making the hard choices.

“Iowans want common-sense responsible policies even when it requires going against the grain. We cut taxes when many said our budget couldn’t handle it; we kept our economy open when few others were; we chose growth over government even when it was hard. As a result, our fiscal health is strong, and our tax code is more competitive than ever,” stated Gov. Reynolds.

Tax reform is far from finished in Iowa. By continuing to follow fiscal conservatism and prudent budgeting rates can be lowered even more until the goal of eliminating the income tax is achieved.

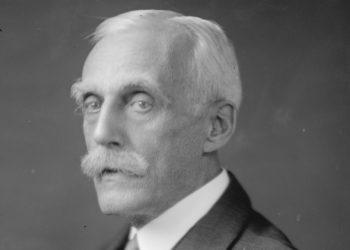

Governor Reynolds fiscal policy is a reminder of President Calvin Coolidge who regarded “a good budget as among the noblest monuments of virtue.” Coolidge understood the need the importance of keeping spending levels low to achieve both lower tax rates and economic growth. Coolidge also understood the importance of saying “no” to achieve fiscal stability. Governor Reynolds is following a Coolidge-style fiscal policy.

Iowa now joins North Carolina as a gold standard example for state fiscal policy.