President Joe Biden announced that his administration will offer up to student loan forgiveness up to $20,000 for borrowers who earn less than $125,000 and $250,000 for married couples.

Those who did not qualify for a Pell Grant in college are eligible for $10,000 in student loan forgiveness. Those who met the financial criteria to receive a Pell Grant in college are eligible for $20,000 in loan forgiveness.

The U.S. Department of Education proposed a new income-driven repayment plan that caps monthly payments for undergraduate loans at five percent of a borrower’s discretionary income, which is half the rate borrowers pay under most existing plans. Biden also said the administration would fix the Public Service Loan Forgiveness program by proposing a rule that borrowers who have worked at a nonprofit, in the military, or in federal, state, tribal, or local government, receive appropriate credit toward loan forgiveness.

“An entire generation is now saddled with unsustainable debt in exchange for an attempt, at least, at a college degree,” Biden said. “The burden is so heavy that even if you graduate, you may not have access to a middle-class life that a college degree once provided.”

Republican critics of the plan see student loan forgiveness as additional inflationary spending with an expected price tag of more than $400 billion and that it does not address the rising costs of higher education.

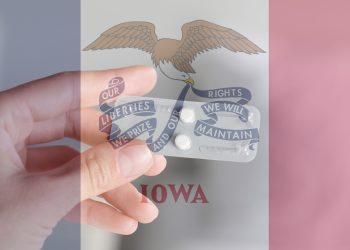

U.S. Senator Joni Ernst, R-Iowa, also said that student loan forgiveness is unfair to those who didn’t attend college and those who paid off their debt.

“Why should Iowans who chose to go straight into the workforce or pay for their own education foot the bill for master’s degrees for the wealthy? It is unfair and will fan the flames of inflation and add to our growing federal debt,” she said.

Approximately half of student loan debt incurred is from those who attended graduate school.

“Instead of putting a band-aid on the problem and passing the buck, we should be giving students and their families a clear picture upfront about the true costs associated with their education. That’s why I introduced my Student Transparency for Understanding Decisions in Education Net Terms Act—a commonsense way to help students make informed decisions about their future,” she said.

In a tweet, U.S. Senator Chuck Grassley, R-Iowa, pointed to economists who warned about inflationary spending and that student loan forgiveness would increase tuition costs.

U.S. Rep. Ashley Hinson, R-Iowa, also called the student loan forgiveness a “handout” to wealthy Americans.

“President Biden’s plan to ‘cancel’ student loan debt is a handout to the wealthy and a total slap in the face to working Americans. Those who didn’t go to college, or those who have worked hard to pay off their student loans, should not be on the hook for someone else’s degree. We have to put a check on the Biden Administration’s out of control spending habits and continued disrespect for taxpayers,” she said.

U.S. Rep. Mariannette Miller-Meeks, R-Iowa, called the plan a debt transfer.

“This decision is irresponsible, it’s unfair, and undercuts students who work to afford tuition and parents who for years sacrificed and saved for the opportunity of a college education,” she said. “It is a debt transfer from those taxpayers who forego college. Student loans shouldn’t be viewed any differently than a mortgage or car loan – money taken out must be paid back by those who benefit.”

U.S. Rep. Randy Feenstra, R-Iowa, echoed his Republican colleagues.

“This massive redistribution of wealth to the wealthiest and most educated Americans is a disservice to Iowa taxpayers who have responsibly paid off their own loans. Just like the rest of Biden’s agenda, this decision will make inflation even worse,” he tweeted.

The President’s plan could also face court challenges from Republican attorneys general. Brenna Bird, a Republican challenging Iowa Attorney General Tom Miller, a Democrat, promised she would sue the Biden Administration.

“The Biden Administration’s student debt policy is short sighted, and so is the legal justification. Paying the student loans of theater majors is not an emergency that warrants presidential action – the crisis at our border, however, is,” she said. “The President ignores the border while illegal drugs flow through that are devastating Iowa communities. Once again, this President has continued to defy common sense and our Constitution, and when I am elected Attorney General, I will take him to court.”

Iowa’s lone Democratic member of Congress was noticibly quiet about the announcement.

U.S. Rep. Cindy Axne, D-Iowa, in a hotly contested race in Iowa’s 3rd Congressional District against Republican State Senator Zach Nunn, did not comment publicly about the announcement before publication. Nunn has not yet commented either. State Rep. Christina Bohannan, D-Iowa, the Democrat challenger to Miller-Meeks in Iowa’s 1st Congressional District race has not issued a public statement and neither has Ryan Melton who is challenging Feenstra in Iowa’s 4th Congressional District race. State Senator Liz Mathis, D-Hiawatha, the Democratic challenger to Hinson in Iowa’s 2nd Congressional District race, Radio Iowa reported said “the president’s plan falls short in addressing the root problems of college affordability.”

Mike Franken, the Democratic challenger to Grassley in Iowa’s U.S. Senate race, called aspects of the plan a “welcome first step,” but pointed out it didn’t’ address tuition costs.

“Today’s announcement from the President, especially the improved IDR structure and interest capitalization provisions, is a welcome first step. It does not replace the need for meaningful legislation to help lower the cost of attending college and trade schools,” he tweeted. “We must also invest in job training and technical education programs for the trades. While college isn’t for everyone, everybody needs a job.”