Once again it appears that policymakers in Washington, D.C. are trying to further centralize power and squeeze the sovereignty of the states. Federalism, which refers to the division of power between the federal government and the states, is a pillar of American constitutionalism. The United States House of Representatives Judiciary Committee has a bill before them that would set a dangerous precedent regarding tax policy if enacted. It’s called the STAMP Act which stands for ‘Stop Taxes Against Menstrual Products Act of 2022’. It would tell states and local governments that they cannot levy a sales tax on the retail sale of menstrual products.

This is not the first time in recent memory Beltway Democrats have tried to interfere with state tax policy. The American Rescue Plan Act (ARPA) provided stimulus funds to states and localities for the purposes of pandemic relief. The Biden administration attempted to prevent states from cutting taxes with any of those dollars. Fortunately, numerous states, including Iowa, challenged this stipulation and multiple federal courts have ruled that Biden’s overreach was unconstitutional.

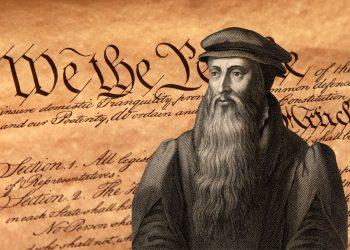

For decades, federal policymakers have forgotten or simply ignored the limits placed on them by the Constitution. With regards to taxation specifically, the federal government levies an income tax, but sales and property taxes have been left to the states since our nation’s creation. Founding Father James Madison wrote that the Constitution had few and defined powers:

The powers delegated by the proposed Constitution to the federal government are few and defined. Those which are to remain in the State governments are numerous and indefinite. The former will be exercised principally on external objects, as war, peace, negotiation, and foreign commerce; with which last the power of taxation will, for the most part, be connected. The powers reserved to the several States will extend to all the objects which, in the ordinary course of affairs, concern the lives, liberties, and properties of the people, and the internal order, improvement, and prosperity of the State.

Further, the Tenth Amendment to the Constitution affirms Madison’s perspective: “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.” In this case, the federal government has chosen to let the states levy sales taxes, thus they need to also respect the states when it comes to their exemptions, or lack thereof.

The Bill of Rights itself was passed to reassure those Americans who worried the federal government would assume powers that would directly interfere with the sovereignty of the states, including taxation. The STAMP Act is just another example of Washington inserting itself into a policy area that should be a concern for state legislatures and not the Congress. Unfortunately, it appears the fears of a federal power grab are still justified over 200 years later.

The federal government has no right to tell Iowa what it can and cannot tax. These are decisions that should be made in Des Moines, not Washington, D.C. Interestingly enough, Iowa arrived at its own conclusion on feminine products earlier this year. In June, the Iowa Legislature enacted SF 2367 which included the creation of an exemption for feminine hygiene products and child and adult diapers.

From an ideal tax policy perspective, sales taxes should be applied to all final consumer purchases, without any regard to whether the items are classified as luxuries or necessities. Having a broad sales tax base does not distort preferences across goods or services, it allows for the lowest possible rate, and it means a consumer does not have to choose between one item that is taxed versus another item that isn’t. Exempting items from taxation chips away at the stability of the sales tax base and in the long run contributes to higher overall rates.

Exempting those hygiene products may not fit our definition of ideal tax policy, but it was correctly left up to the state of Iowa and its elected officials to make that decision. Whether you share our view of exemptions or not, federally mandated exemptions seemingly violate the Tenth Amendment. In the case of the STAMP Act, the federal government should not pretend that it’s OK for them to tell the states what to tax unless they want more lawsuits like the ones brought against them when they went too far with ARPA guidelines.

The STAMP Act is another assault upon constitutional government and bad policy.