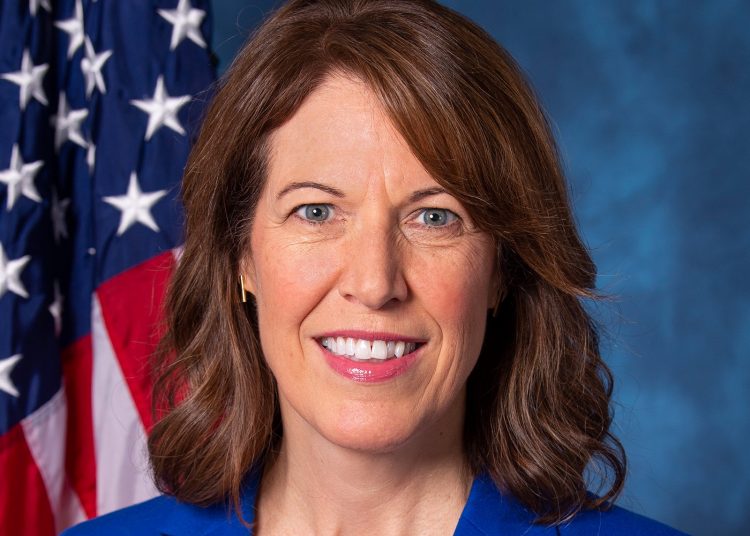

DES MOINES, Iowa – On Wednesday, U.S. Rep. Cindy Axne, D-Iowa, joined 20 House Democrats urging House Leadership to remove a provision in the “Bulid Back Better Act” that provides the Internal Revenue Service (IRS) information about bank transitions or $600 or more.

The original proposal published in a U.S. Treasury Department document in May would require banks annually to turn over to the IRS data for all business and personal accounts from financial institutions, including bank, loan, and investment accounts holding more than $600. Banks, under the proposal, would report on “gross inflows and outflows” with a “breakdown for physical cash, transactions with a foreign account, and transfers to and from another account with the same owner.”

The document also said that banks would report “not only gross receipts but also gross purchases, physical cash, as well as payments to and from foreign accounts, and transfer inflows and outflows.”

“Requiring comprehensive information reporting on the inflows and outflows of financial accounts will increase the visibility of gross receipts and deductible expenses to the IRS. Increased visibility of business income will enhance the effectiveness of IRS enforcement measures and encourage voluntary compliance,” the document said, explaining the rationale for the proposal.

“While the intent of this proposal is to ensure all taxpayers meet their obligations—a goal we strongly share—the data that would be turned over to the IRS is overly broad and raises significant privacy concerns,” the members in the letter wrote. “We have little information about how the IRS plans to protect or use this massive trove of data. Americans expect their bank or credit union to safeguard their financial information.”

Read the letter below:

Axne IRS LetterAxne had previously raised concerns to House leadership and her colleagues about an earlier version of this proposal.

“While I certainly think we need to be looking at ways to crack down on wealthy tax dodgers, I oppose implementing something that could up scoop up information on middle-class Iowa families and create massive amounts of red tape for our small community banks and lenders,” she said. “We need to ensure the top one percent are paying their taxes, but this proposal goes too far.”

Axne told KCCI that she would not support the bill as written but suspected the IRS proposal would be removed from the bill. Instead, the IRS proposal was included in the final draft of the bill.

Republicans are upping the pressure on Axne to go against her caucus. The National Republican Congressional Committee released an ad on Wednesday targeting the two-term congresswoman over the IRS proposal.

The Republican Party of Iowa asked whether she would reverse her stance and vote for the bill.

“Axne doesn’t get to hide from this. If she votes for this bill, Axne is green lighting the federal government to take unprecedented action against American citizens,” Kollin Crompton, spokesman for the Republican Party of Iowa, said. “Axne and her liberal counterparts are leading the unhinged federal government, constantly attacking the freedoms and liberties of the American people.”

Iowa’s House Republicans are firmly against the proposal.

U.S. Rep. Ashley Hinson, R-Iowa, introduced the Protecting Financial Privacy Act to block the IRS from monitoring bank transactions.

“It’s an unprecedented invasion of privacy. It would give the IRS the ability to monitor Americans’ financial transactions and bank accounts at a granular level. The IRS does not need to spy on the bank accounts of Iowa families, farmers, and small businesses. They don’t need to be monitoring these basic personal transactions,” she said during a press call this month.

Hinson and U.S. Reps. Mariannette Miller-Meeks, R-Iowa, and Randy Feenstra, R-Iowa, joined a letter sent to Treasury Secretary Janet Yellen on October 21, 2021, outlining their concerns with the Biden Administration’s proposal to expand the data collected by the Internal Revenue Service (IRS) on Americans’ bank accounts.

Senate Democrats, with support from Yellen, raised the reporting threshold from $600 to $10,000.

Miller-Meeks said that is still a violation of privacy.

“The Administration’s continued push to invade Americans’ privacy should concern everyone. Raising the reporting threshold from $600 to $10,000 still means the overwhelming majority of Americans will be targeted by the IRS,” she said. “The Treasury Department’s response to our September 13 letter was unacceptable and I am proud to join this second letter to show the Administration that we will not back down. I will continue to fight to ensure that all Americans’ right to privacy is protected.”