I make it a priority to keep in touch with Iowans and to listen to their thoughts and concerns.

Whether at one of my 99 county meetings or during the a match-up of Iowa State versus my alma mater, Northern Iowa, I meet Iowans where they are and listen to what is on their mind.

During this past state work period, I had multiple conversations with farmers about what is on their mind.

At the UNI – Iowa State game, I had a conversation with Ron Heck, a farmer from Perry, Iowa, where he talked about the concerns about President Biden’s tax plan.

Ron followed up with an email to me, which I want to share with my colleagues on the floor since this is a theme I’ve consistently heard across the state.

Ron started the email by saying, “Iowa farmers have a problem with exploding land prices, coupled with Biden’s increasing death and transfer taxes.”

He said, “A tax at death or transfer can’t be paid back by younger working farm families. Young Iowa farmers would become feudal servants to banks and landlords from outside of the state.

There are many cliches and articles written about this. I have seen some that don’t seem to grasp the problem.”

Then Ron highlighted some key statistics on the lack of available Iowa farmland.

“In Iowa, from the third quarter of 2020 through the second quarter of 2021, the Center for Agricultural and Rural Development at Iowa State University says 181,046 acres of Iowa farmland has been available on the market.

Out of about 30 million crop acres, this is 0.6 percent in a year. Everyone knows that it might be 100 years before a parcel is available again, so you need to buy it now is always said by the auctioneer.

A Des Moines Register article from June 28, 2018, by Donnelle Eller says that only 7 percent of Iowa farmland owners intend to sell to a non-family member.

Ron made this point to show that public auction prices are high because of the scarcity of available farmland. These prices should not be used for family tax-transfer valuations for taxation.

Ron continued with facts on the price of this farmland, “Outsiders believe the value is there, but in fact, farm families don’t want to sell, so the auction price goes up.

Ron said, “In August, there were forty Iowa farmland auctions with most of the sales between $10,000 to $16,000.

Assuming a taxable gain of $10,000 per acre, Biden’s tax plan could be $4,400 per acre.

Ron told me that, “At a minimum, this would be a $200 per acre cash rent for 22 years to the US government, all payable in advance.”

He added, “This is confiscation, not taxation.”

Ron said that since the $4,400 must be paid for with after tax dollars, it would take double this amount to pay it back. Interest charges could make the payback period more than 50 years, just to pay the U.S. government.”

Ron finished his email by saying, “It doesn’t take much outside money to raise havoc with Iowa farmland auctions.

“Estate or transfer taxes will ultimately destroy Iowa’s farm culture.”

Ron, thanks for taking the time to write to me.

It’s my job to respond to the comments and do something about it. I want to urge my colleagues to join together and oppose changes that will impact family farmers.

Iowa farmers feed and fuel our country and the world.

Ensuring that the next generation of farmers are able to keep the land in their family is in our national interest.

Biden’s tax and spend proposals will be bad for small businesses, for farmers, and for all Iowans.

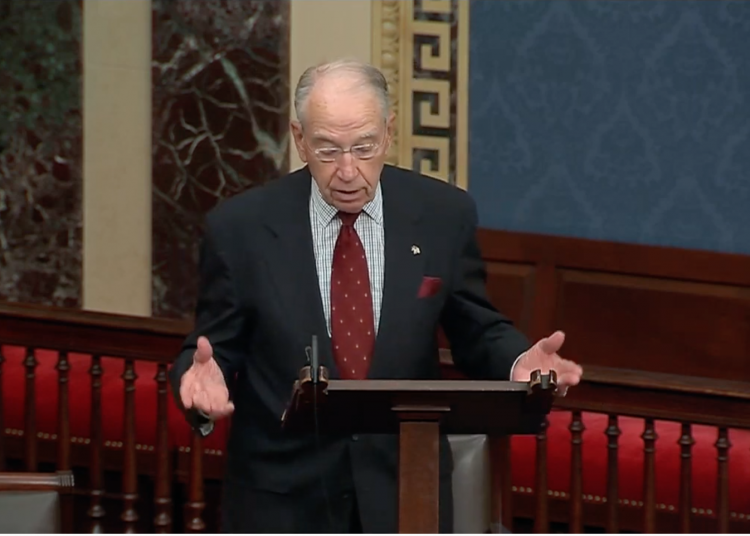

Note: This op/ed is the transcript of a speech that U.S. Senator Chuck Grassley, R-Iowa, gave on the U.S. Senate floor on Wednesday, September 22, 2021.