WASHINGTON — On Wednesday, the U.S. House of Representatives passed two pieces of legislation authored by U.S. Rep. Cindy Axne, D-Iowa, she says is aimed at improving transparency for public companies and leveling the playing field for Iowa’s small businesses, workers, and investors.

The Disclosure of Tax Havens and Offshoring Act and the Workforce Investment Disclosure Act both passed the House on Wednesday within a package of bills that will update disclosure requirement rules for U.S. corporations.

“For decades, we’ve accepted that publicly traded corporations should regularly provide operating information about their business to the public in the interest of those looking to invest in their company and those whose hard-earned dollars can be included in those investments. But the current disclosure requirements do not adequately cover the realities of the modern world – and allow corporations to avoid U.S. taxes, offshore U.S. jobs, and underinvest in the workers that keep their companies strong,” Axne said. “Iowa’s small businesses and our workers are on an unequal playing field with these big corporations. Shining a light on how these corporations are operating can help tip the balance back towards the average American while protecting our investors and retirees. I’m proud that the House has taken this important step forward in updating these requirements by passing two of my bills – and other important provisions – and I look forward to working with my Senate colleagues and SEC Chair Gensler to get these requirements updated.”

The Disclosure of Tax Havens and Offshoring Act provides investors and the public with transparency on corporations’ use of tax havens and tax incentives to outsource American jobs. The bill requires public corporations to disclose their financial reporting on a country-by-country basis so Americans can see the extent to which they are abusing tax havens or offshoring jobs.

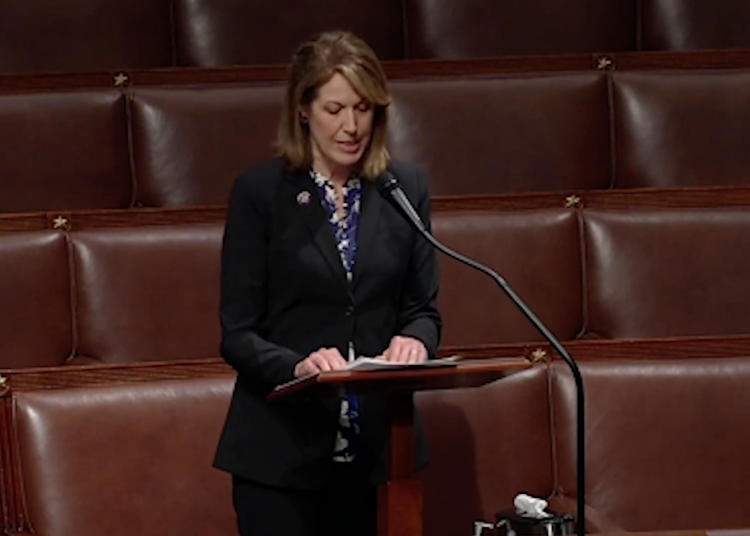

Axne urged her colleagues to pass the Tax Havens and Offshoring Act earlier on Wednesday on the floor of the U.S. House.

The Workforce Investment Disclosure Act updates disclosures that are currently inadequate to give investors a full picture of how modern businesses are investing in the safety and skills of their workforce. The bill would require public companies to report basic human capital metrics, including workforce turnover rates, skills and development training, workforce engagement, pay and benefits, and workforce health and safety.

Axne also spoke in favor of that legislation, which was added by amendment prior to the House passing the final package.

The bills were included in the Corporate Governance Improvement and Investor Protection Act, a package that also made other updates to current requirements, including requiring disclosure of:

- Whether a company’s board includes a person with expertise in cybersecurity, in light of recent uptick in cyberattacks and ransomware attacks.

- Whether manufactured goods are produced in the Xinjiang province of China, where many of the local Uyghur minority population have been interred in forced labor camps, and whether those products are produced using forced labor.

- What financial and physical risks a company faces from the increasing effects of climate change.

The Disclosure of Tax Havens and Offshoring Act, which was introduced with U.S. Senator Chris Van Hollen, D-Md., in May, has the support the American Federation of Labor (AFL-CIO), American Federations of State, County, and Municipal Employees (AFSCME), Americans for Tax Fairness, Coalition on Human Needs, Consumer Federation of America, the FACT Coalition, Institute for Taxation and Economic Policy, International Brotherhood of Teamsters, NAACP, National Employment Law Project, National Organization of Women, Public Citizen, SEIU, Tax March, United Auto Workers, and United Steelworkers.

The Workforce Investment Disclosure Act, which was introduced with U.S. Senator Mark Warner, D-Va., has the support of the Human Capital Management Institute, International WELL Building Institute, the National Employment Law Project, and the California State Teachers Retirement System (CalSTRS).