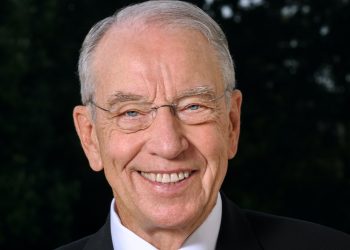

WASHINGTON – The Senate last Friday unanimously passed bipartisan legislation authored by U.S. Senator Chuck Grassley, R-Iowa, to preserve a whistleblower program in danger of collapsing under its own success. The CFTC Fund Management Act (S. 409) ensures that the Commodity Futures Trading Commission’s whistleblower program can continue to function even when awards obligated to whistleblowers exceed the program fund’s balance at the time of distribution. The bill, which carries no cost to taxpayers, is also cosponsored by U.S. Senators Maggie Hassan, D-N.H., Joni Ernst, R-Iowa, Tammy Baldwin, D-Wis., and Susan Collins, R-Maine.

“The CFTC whistleblower program has become far more successful than Congress imagined when we set it up back in 2010. Some awards distributed to whistleblowers have grown to the point that they risk wiping out the award fund before it can be replenished, sidelining program staff and operations in the process. We can’t allow this program to become a victim of its own success. Now that the Senate has passed this bill, the House must act quickly to preserve the program,” Grassley said.

The Commodities Futures Trading Commission (CFTC) relies on whistleblower disclosures to identify cases of fraud and other illegal activities, and collect fines on behalf of the American people. The CFTC’s Customer Protection Fund, established by Congress in 2010, is funded through those fines and used to reward whistleblowers for their disclosures. That fund is also used to pay for operating expenses and educational initiatives associated with the whistleblower office. Under current law, the Customer Protection Fund is capped at $100 million, and any fines collected after the account reaches the cap are remitted to the Treasury’s general fund. In recent years, the increasing size and quantity of fines stemming from successful whistleblower disclosures have led to larger reward disbursements, which risk depleting the fund before it can be replenished.

The CFTC Fund Management Act, as amended by the Senate, temporarily establishes a separate account at the U.S. Treasury to house funds used to pay operating and programming expenses. The creation of a separate account guarantees that the office will be able to continue operations should the overall amount held in the Customer Protection Fund drop to a critical level.