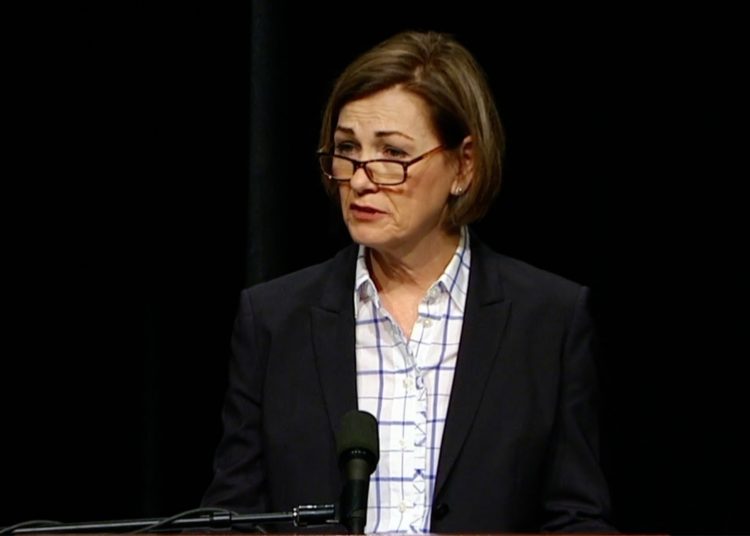

A recent editorial by the Des Moines Register asks the question of whether the push for “smaller” government in Iowa has achieved a point where it is “too small to work.” The editorial argues that those who believe in a “smaller, more efficient” government fail to address how limited government can solve some of the policy problems confronting Iowa. In other words, the Register’s editorial is arguing that the fiscal conservatism of Governor Kim Reynolds and the Republican-led legislature has led to hollowing out government, but this argument is not only untrue but ignores the record that progressive “big government” does not work. Following a policy of fiscal conservatism by keeping spending low and reducing tax rates not only creates economic growth but also provides for the priorities of government.

Governor Kim Reynolds and the Republican-led legislature in recent years have been following a policy of fiscal conservatism. As a result of prudent budgeting, Iowa’s fiscal house was in strong condition as the COVID-19 pandemic hit. Currently, Iowa has a budget surplus, the reserves are full, and revenues continue to grow. If Iowa followed similar tax and spend policies as our neighbors in Illinois or other progressive “Blue” states such as New York or California, our fiscal house would not have been able to withstand the economic recession that was triggered by the pandemic.

A policy priority for Governor Reynolds is making Iowa’s economy more competitive. The Governor understands that high individual and corporate income tax rates are not only harmful, but they deter economic growth. To make Iowa’s economy more competitive, Governor Reynolds and the Republican legislature passed a tax reform measure in 2018 that lowered both the individual and corporate tax rates.

Governor Reynolds understands that for Iowa to be more competitive, Iowa’s high tax rates must be reduced. Iowa is in competition with other states for both jobs and people. Projections from the Census demonstrate that states that do not have an income tax or low tax rates are gaining people. Montana, which recently passed a conservative budget and lowered its income tax, will gain one seat in Congress. An exodus is occurring in high-tax states such as New York and California.

In addition to lowering tax rates, the Governor and the legislature have been prudent with state spending. This does not mean that spending has declined, and it is only in government that slowing the growth of spending is viewed as a “cut.” From 2013 to 2020, Iowa’s budget has grown 1.6 times faster than population growth plus inflation. Last year’s budget (FY 2021) which was passed during the pandemic was considered a “status quo” budget, which increased spending slightly from the previous year. This is hardly austerity-style budgeting.

Governor Reynolds and Republican legislators have also made workforce development and education major priorities. Since 2011 Republicans have “invested nearly $1 billion” in public education. If policymakers want to spend more money on areas such as public safety and the justice system, then reform will need to come to the two largest areas of the budget, Health and Human (DHS) services and education. In Fiscal Year 1995, DHS, with Medicaid being the largest driver, and education consumed 47 percent of the budget. Today these programs consume over 75 percent of the budget. Both continue to increase and as a result crowd out funding for other priorities such as public safety.

Discussions can be had about increasing funding for various programs, but government needs to be respectful of taxpayer dollars. Everyday households and businesses across Iowa prioritize spending and government should be held to the same standard. Too often government forgets that the money they are spending comes from taxpayers. Progressives often argue that government needs to spend or “invest” more, but they fail to acknowledge how much spending should increase and whose taxes should be increased to generate the needed revenue.

Spending more money and hiring more government employees does not necessarily translate into better public policy. As an example, North Carolina has followed a policy of fiscal conservatism by limiting spending and reducing tax rates, and they are still able to provide for the priorities of government. “Since 2011, North Carolina legislators have kept government growth in check even as they increased spending on teacher pay and Medicaid. They have cut taxes and built-up healthy reserves to get through natural disasters and economic recessions. People and jobs have come to North Carolina in response leading to faster economic growth,” wrote Joseph Coletti, a Senior Fellow who specializes in fiscal policy at the John Locke Foundation.

Governor Reynolds understands that growing government and increasing taxes will be detrimental for Iowa. She has correctly rejected the failed “Blue” state policy model of spending and tax increases. Whether it is keeping Iowa’s economy open during the pandemic or following a policy of fiscal conservatism, Governor Reynolds is making Iowa more competitive and creating more opportunities.

Governments cannot tax and spend their way to prosperity. Iowa should look to other states such as North Carolina, Utah, Florida, among others that are demonstrating that not only does fiscal conservatism work, but it leads to a better quality of life. Iowa does not want to become another Illinois or California.

President Ronald Reagan once said, “Well, the trouble with our liberal friends is not that they’re ignorant; it’s just that they know so much that isn’t so.” This statement applies to the “Blue” state policy model.