Tax rates matter and they have a significant role in how competitive a state economy is in relation to other states. Higher tax rates penalize hard-working individuals, families, and businesses and deter economic growth, making a state less competitive.

To make Iowa more economically competitive, Governor Kim Reynolds has made tax reform a priority. Taxes on income, which include both individual and corporate income taxes, are considered the most harmful of taxes due to their negative impact on economic health.

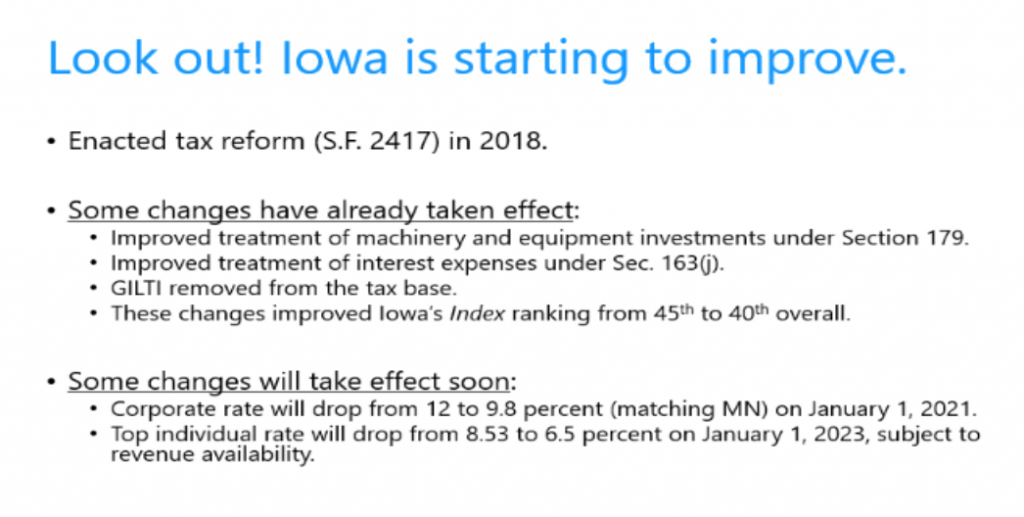

In 2018, Governor Reynolds and the Republican-led legislature passed pro-growth tax reform that lowered income tax rates and broadened the sales tax base. Reducing tax rates and practicing fiscally responsible spending policies is making Iowa more competitive and economically strong.

This year as a result of the 2018 tax reform law the corporate tax rate was reduced from 12 percent, the highest in the nation, to 9.8 percent. Iowa’s new top corporate tax rate will match Minnesota’s. Iowa’s corporate tax will have four brackets, ranging from 9.8 percent to 5.5 percent. High corporate taxes in Iowa discourage productivity, hiring, and investing in Iowa.

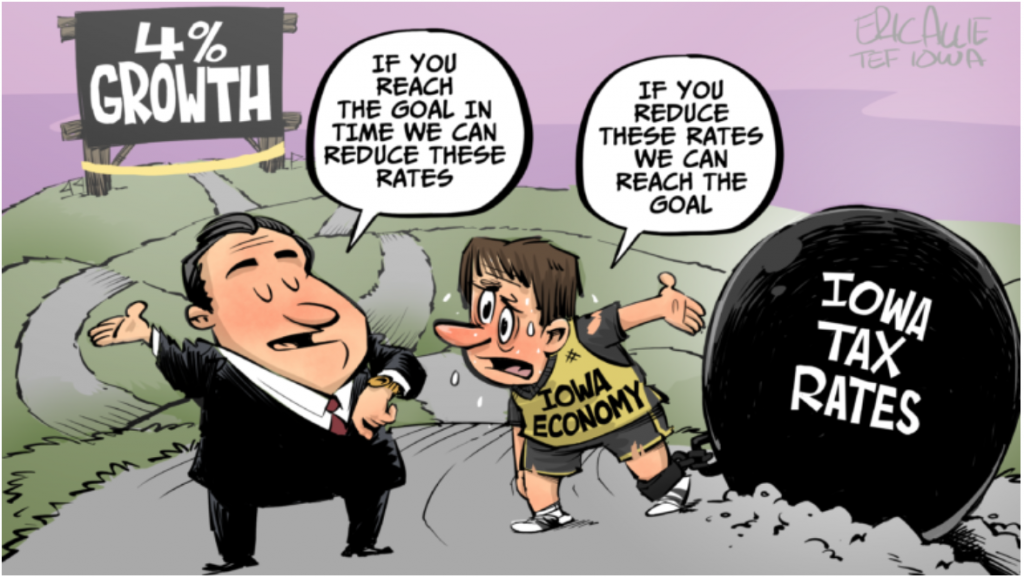

In 2023, the income tax is scheduled to be reduced to 6.5 percent. The caveat is, for the rate reduction to occur, it must meet two stringent revenue triggers. The first, state revenues must surpass $8.3 billion, and the second requires revenue growth of at least four percent during that fiscal year. The use of revenue triggers in state tax policy is a good idea but creating a high threshold can unnecessarily delay tax rate reductions. The four percent growth trigger also places spending interests above those of the taxpayer.

Lowering the income tax should not be hindered by the 4 percent growth trigger. Repealing the revenue triggers would reduce a major roadblock to income tax relief and provide more certainty for taxpayers.

Many states have or are gradually lowering both their personal and corporate income tax rates. For Iowa to remain economically competitive, it must follow suit. Iowa’s tax rates matter because we are in direct competition with 49 other states for businesses, jobs, and people. For example, South Dakota, Iowa’s neighbor, foregoes taxing individual or corporate income, making it far more economically competitive.

Iowa is making progress in lowering personal and corporate income tax rates, but more work is needed to lower tax rates. People and businesses respond to tax climates, and the evidence is clear from high tax states that are undergoing an exodus of both people and businesses.

Iowa understands that reducing tax rates will lead to more growth and opportunity. Eliminating the revenue triggers will help make Iowa’s tax code even more competitive. By balancing prudent spending with lowering tax rates, Iowa is moving to become a pro-growth leader in the Midwest.