Since last March, Congress has approved $4 trillion to fight the pandemic and help hard-hit U.S. households put food on the table and keep a roof over their heads.

Five bipartisan COVID-relief laws included two rounds of direct payments, expanded unemployment benefits, nutrition assistance, relief for student borrowers, and emergency rental assistance for low-income families. Plus, the CARES Act delivered a financial lifeline to small businesses with a forgiveable loan program.

Congress replenished the Paycheck Protection Program (PPP) and gave struggling businesses more flexibility to help America’s vital network of Main Street employers survive and recover. Congress also approved tens of billions of dollars to help schools safely re-open. And yet, the lion’s share of pandemic relief for schools remains unspent.

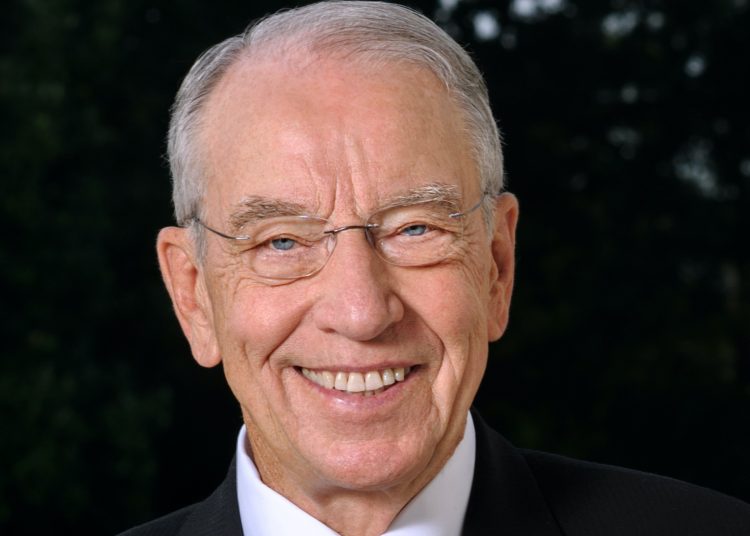

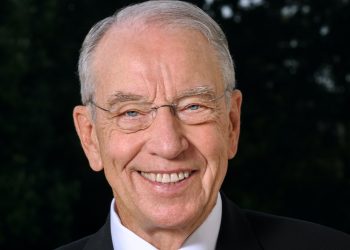

During negotiations on COVID relief last year, I led the charge to make sure rural health care providers weren’t left behind as they served their communities on the front lines of the pandemic. As the distribution of the vaccine ramps up, I’m pushing the Centers for Disease Control and Prevention (CDC) for transparency to ensure Iowa gets its fair share. With a third vaccine nearing emergency approval, the light at the end of the COVID tunnel keeps brightening.

Although lower infection rates and more vaccinations are good news, it can’t erase the grim and tragic reality that more than 500,000 Americans, including over 5,000 Iowans, have lost their lives to the virus. That’s why Congress must keep its eye on the ball: fighting the pandemic, not milking COVID as a cash cow for special interests.

As written, President Biden’s $1.9 trillion proposal blows out the budget to finance an agenda unrelated to the pandemic. Sending borrowed taxpayer dollars to sectors of the economy and households that don’t need it is wasteful. What’s more, it could fuel inflationary pressures that would backfire on the economic recovery. Make no mistake. When Washington prints more money to buy more debt to pay for pet projects, earmarks, and wasteful projects, our fiscal ship will sink in a sea of red ink.

Without question, more help is needed. But it needs to be targeted to those who most need it. For example, unemployed workers in the restaurant, hospitality, and travel industry are among the hardest hit Americans due to government-imposed restrictions that effectively took away their livelihoods. Other sectors are booming, especially the housing industry.

Until the economy gets back to full throttle, Iowans who have been furloughed or lost their jobs through no fault of their own absolutely need help. That’s why I supported extensions of pandemic-related unemployment insurance and direct payments in the COVID-relief packages Congress enacted with bipartisan support last year.

However, policymakers must learn when good intentions lead to unintended consequences. I heard from struggling small businesses in Iowa who found it harder to get people back to work when unemployment checks were higher than wages those employees made before being laid off. This issue underscores the jeopardy a $15 federal minimum wage would have on communities with different costs of living in different areas of the country.

Many restauranteurs and other small business owners eke out a living on a razor-thin profit margin. We have lost some such businesses perhaps for good and others are hanging on by a thread thanks to the PPP program. For many places in Rural America, a $15 dollar minimum wage would create an unaffordable mandate for small businesses to bounce back, let alone expand their operations and hire more workers in the future. The nonpartisan Congressional Budget Office says a $15 federal minimum wage would kill jobs for 1.4 million workers.

U.S. households that haven’t lost wages or paychecks during the pandemic shouldn’t receive transfer payments from the U.S. Treasury. As Congress considers a third round of Economic Impact Payments, the Biden administration needs a reality check before it sends out checks to households with incomes up to $200,000.

Sending borrowed money to those who don’t need it won’t stimulate the economy. It will needlessly add to the debt and poke the sleeping giant: inflation. The bottom line is pretty simple. The sixth so-called COVID-relief bill needs to do just that, target spending to get the pandemic behind us and get our economy and schools back open.

As written today, less than ten percent of Biden’s $1.9 trillion plan would fight the pandemic. The other 90 percent pays for a liberal laundry list, including $350 billion of our tax money to bail out states who, unlike Iowa, mismanaged their own budgets, to push an agenda that has nothing to do with fighting the pandemic.