DES MOINES, Iowa – An Iowa Senate subcommittee unanimously approved SSB 1026 that, if passed, would repeal Iowa’s inheritance tax and the state’s qualified use inheritance tax.

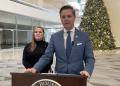

State Senators Dan Dawson, R-Council Bluffs, Annette Sweeney, R-Alden, and Janet Petersen, D-Des Moines, recommended the bill’s passage.

Only one speaker during the subcommittee hearing on Tuesday afternoon spoke out against the bill.

Rev. Brian Carter, a lobbyist for the Iowa Conference of the United Methodist Church, said that the repeal would be “unfair.” He said that taxes should help “equalize the conditions of people in the state.”

“I myself have been profited from wealth accumulated by my ancestors and passed down to me. But I don’t particularly see that as a fair advantage. I think we need to have an inheritance tax because we shouldn’t let people accumulate wealth from the past, who just live off that wealth in the present,” he said, arguing for wealth redistribution.

“The inheritance tax is a fair tax, is a needed tax and a central tax for our state, and that should not be abolished. It is not a death tax. It is an inheritance from the past. Because somebody in the past and your family was able to accumulate wealth, it passed down to you, not because of your ability or you’re deserving, but just because you are part of a family,” Carter added. “But we are part of a larger family, the American family, and all people should have some fair share of that wealth.”

Drew Klein, with Americans for Prosperity, pointed out that the state has an equal protection issue with the law as written.

“It’s codified fairly unequally based on whether somebody is able to have children or chooses to have children,” he said.

“And so when we look at the way that we’re applying it in Iowa, somebody’s ability to pass a piece of property or the work of their life on to a niece or a nephew or anybody of their choosing, really, that for us is is appropriate, and certainly their right. They’ve paid taxes throughout their life. And there’s no real reason that the state should impose a new tax on them or continue to impose this new tax on them because they happen to die,” he added in support of the bill.

Victoria Sinclair with Iowans for Tax Relief pointed out that Iowa is one of only six states with an inheritance tax. Nebraska, Kentucky, Pennsylvania, New Jersey, and Maryland also have an inheritance tax.

She said the tax currently encourages people to keep their inheritance within families as the tax only applies to non-linear relations.

“You can’t give this to like a business partner or the kid down the street you’ve been farming with for a decade. It really does have the opposite effect. Also, add the assets that are transferred aren’t always liquid, like land or a small business. So without the liquid capital to pay the inheritance tax, that could actually force the sale of a small business or a family farm, which shouldn’t be the goal that good tax policy strives to achieve. Frankly, people are taxed enough while they’re alive, it’s time for Iowa to quit robbing the grave and quit taxing people even after they are dead. Iowa is a great place to live, but it’s a terrible place to die. So it’s time to make it better,” she added.

Matt Everson, the Iowa state director for the National Federation of Independent Businesses (NFIB), echoed what Klein and Sinclair said.

“Most of our small businesses are asset-heavy, cash poor. I think we’ve seen that through the pandemic where small businesses have had to survive off of PPP loans and things like that. And so the inheritance tax, you know, it’s a real small business killer. We see it all the time, and even more so in rural Iowa. So hopefully, this is the year that we get rid of this egregious tax,” he said.

Petersen supported the repeal but believes it should go into effect as soon as Gov. Kim Reynolds signs it and not wait until the new fiscal year that starts on July 1.

“I think that the policymakers should not be determining who a person loves and who they should be giving their inheritance to tax-free,” she said.

Sweeney shared how the state’s inheritance tax has impacted Iowa’s farmers.

“With neighbors that would want somebody that had worked for them for years to be able to start farming and with the inheritance law right now, you can’t do that,” she said.

“And I had some friends of mine that live just north of me. They inherited a piece of ground, and they’re still paying for it because of the inheritance taxes. So I think the inheritance tax is a direct business killer. No matter if it’s agriculture or small businesses, it is just not favorable,” Sweeney added.

Dawson, who chaired the subcommittee, wrapped up the hearing.

“It’s been a priority for ours for a few years, and I’m hoping this year is the year to get this thing across the finish line,” he said.

The bill advances for consideration by the full Iowa Senate Ways and Means Committee.

Listen to the subcommittee hearing below: