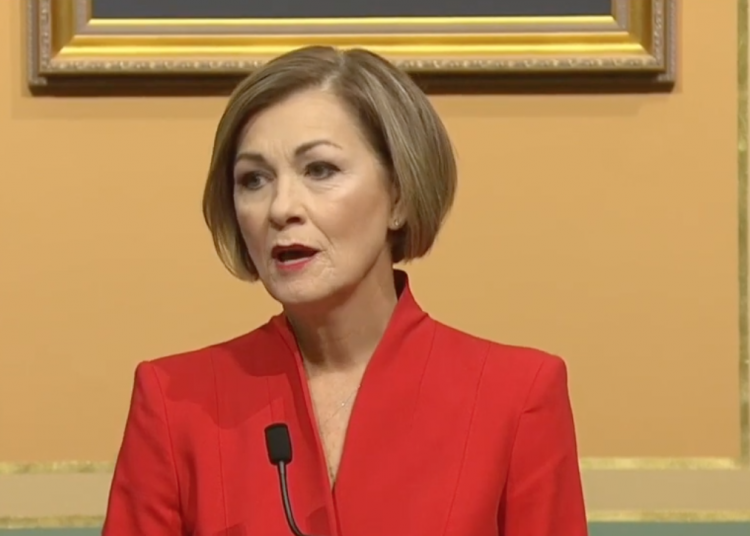

Governor Kim Reynolds in her Condition of the State address outlined a pro-growth policy agenda that will continue to strengthen Iowa’s economic recovery from the COVID-19 pandemic. She also proposed a bold education reform package that will create more freedom and opportunity for parents and children across Iowa. As the legislature begins to formulate policy it is imperative that they continue to focus on conservative budgeting, lowering tax rates, curbing excessive regulations, and expanding educational choice policies that will empower parents with the ability to provide the best education for their children.

This past year Iowa was confronted with unprecedented challenges not only from the COVID-19 pandemic, but also environmental emergencies in the form of a drought and a powerful derecho storm. Nevertheless, Governor Reynolds and the Republican led legislature are starting the legislative session on a strong footing. The Iowa economy is recovering with unemployment at 3.6 percent and an impressive 36 percent growth in gross domestic product (GDP) during the third quarter of 2020.

As a result of following fiscal conservatism Iowa’s budget is in a healthy condition with over $300 million surplus and more than $770 million in reserves. Both Governor Reynolds and the Republican legislature deserve credit for prudent spending and making difficult choices and funding only the priorities of government. Just as families and businesses across Iowa are making difficult economic decisions, state policymakers need to continue to focus on limiting spending and funding the priorities of government.

Governor Reynolds in her speech is working to expand on earlier policies that are creating more opportunities and making Iowa more economically competitive. During the previous legislative session, the legislature passed a landmark occupational licensing reform measure. As Governor Reynolds mentioned in her address “Iowa now has the most flexible licensing reciprocity and recognition” law in the nation.

To build upon this law, Governor Reynolds is calling on the legislature to enact legislation that would review licensing boards and commissions. Iowa policymakers should look to Nebraska, who has enacted legislation that created a review process for occupational licensing. Establishing a review process for licensing and boards is important not only for transparency and accountability, but also to ensure that regulations are not creating barriers to prevent people from earning a living.

Iowa policymakers should create a review process that utilizes both a sunrise and sunset provision. Existing licensing boards and commissions should have sunset provisions which require the legislature to not only review the regulations and requirements, but also require a vote to renew. The same is true for proposed licensing regulations. A sunrise provision would require the legislature to review a new licensing regulation to ensure it does not create a barrier to employment. Sunrise and sunset provisions should be required on all occupational licensing requirements to prevent special interests from trying to control competition in the workplace.

Governor Reynolds stated that the occupational licensing reform law “sends a signal to the country that Iowa is open for business.” Iowa’s tax climate is another crucial factor that determines our economic competitiveness. Governor Reynolds and the Republican legislature in 2018 passed a historic tax reform law that began the process of reducing individual and corporate income tax rates. This year, Iowa’s top corporate income tax rate will fall from 12 percent, the highest in the nation, to 9.8 percent.

In 2023, the top income tax rate is scheduled to be lowered to 6.5 percent, but only if two strict revenue triggers are met. For the rate reduction to occur state revenue must surpass $8.3 billion and the second, requires revenue to grow at least four percent during that fiscal year. Revenue triggers are not necessarily bad policy, but they should not create barriers to make rate reduction more difficult.

Both Governor Reynolds and Republican legislative leaders have made comments that further income tax reduction is needed. In her speech, Governor Reynolds called for continuing the “conversation about cutting taxes,” and she said we can “start by getting rid of the unnecessary triggers that were put in place in 2018.” Eliminating the triggers will provide more certainty and will allow the rate reduction to occur in 2023. Continuing to lower both the individual and corporate income tax rates is important not only to allow families and businesses to keep more of their income, but to make our state more competitive.

Finally, Governor Reynolds called for the legislature to provide more educational choice for parents. The COVID-19 pandemic has brought education policy to the forefront as parents struggle with educating their children and trying to prevent the COVID academic slide from occurring. Governor Reynolds not only called for schools to be open 100 percent, but she also argued that parents need more choice.

“School choice shouldn’t be limited to those who have the financial means or are lucky to live in a district that’s confident enough to allow open enrollment. So, let’s make choice an option for everyone,” stated Governor Reynolds.

Governor Reynolds is proposing to not only expand open enrollment, but also provide more flexibility with charter schools and providing Education Savings Accounts (ESAs) for “students who are trapped in a failing school.”

Iowa policymakers have an opportunity to provide parents with more support in allowing them to seek the best educational opportunity for their children. Providing greater choice in education will create more competition within Iowa’s educational system, which will strengthen schools.

These are not the only issues that Governor Reynolds addressed in her Condition of the State address, but overall, the Governor is continuing to lead Iowa in a pro-growth direction. Governor Reynolds and the Republican legislature have proven to the nation that following fiscal conservatism leads to economic growth, budget stability, and more opportunity for Iowans.