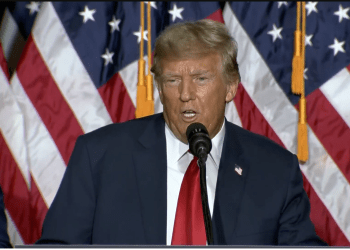

With President-Elect Joe Biden securing over 270 electoral college votes on December 14th and Congress certifying those votes on Wednesday, President Donald Trump must make plans to move out of the White House. While most recognize Donald Trump as a lifelong New Yorker, some may be surprised to learn that is likely not where he will live in his post-presidency days. In fact, in late 2019, President Donald Trump filed a declaration of domicile with the Palm Beach County District Court, effectively changing his official residence from New York to Florida.

While Iowans can understand the allure of warm weather that Florida offers, it is not the only benefit of a move from New York to Florida for President Trump. According to the Tax Foundation’s 2021 State Business Tax Climate Index, which considers the total tax burden imposed by each state (property, corporate, individual, unemployment insurance, and sales taxes), Florida has the 4th-best tax climate in the country. Conversely, New York comes in at 48th on the list, ahead of only New Jersey and California. Iowa’s tax climate ranks 40th, several spots ahead of New York but with much room for improvement.

The top individual income tax bracket in New York is 8.82 percent. New York State has a sales tax of four percent, with New York City adding their own 4.5 percent sales tax rate and an additional .375 percent Metropolitan Commuter Transportation District surcharge, for a total sales tax rate of 8.875 percent in New York City. The average New York property owner pays 1.4 percent of their home’s value in property taxes annually as well. You may be aware that Manhattan real estate isn’t cheap either.

Conversely, the State of Florida has no individual income tax. Florida has a six percent sales tax rate, and Palm Beach County levies an additional one percent sales tax, for a combined sales tax rate of seven percent, nearly two percent lower than the sales tax rate in New York City. The average property owner in Florida pays 0.94 percent of their home’s value in property taxes annually, which is considerably less than New York’s 1.4 percent. By every tax measure, Florida’s tax burden is lighter for its residents than New York’s.

While President Trump may be trading out one swamp for another by moving from D.C. to Florida, rather than Midtown Manhattan, a move to Florida may save him a lot of money in taxes. Plus, it’s warm enough to golf year-round in Florida, which is a perk if you own your own golf course.